Get Started With

servzone

Overview

Due diligence is an audit or examination of a potential investment to ensure that all suggested numbers are correct, which may include analyzing fiscal records. Due diligence often refers to in-depth research and study before signing an agreement or a business with a party.

About the due diligence

- Mergers and Acquisitions:

Diligence is done from the seller's point of view, as well as the buyer's reason. While the consumer looks across a whole range of financial, litigation, patent, and contextual information, the seller focuses on the buyer's experience, the financial ability to complete the transaction and the responsibilities taken.

- Partnership:

Due diligence is done for necessary alliances, necessary connections, business combinations and other such alliances.

- Joint Enterprise and Collaborations:

When one company joins hands with another, the company's credibility is a concern. Assuming other company's stance, including supply sufficiency at their end.

Due Diligence Report

The information collected during this process is essential for decision making and hence needs to be announced. The Due Diligence report helps explain how the company plans to generate further earnings (monetary as well as non-monetary). It acts as a ready reckoner to explain the state of affairs at the time of purchase / sale etc. The ultimate objective is to get a clear understanding of how the business will perform in the future.

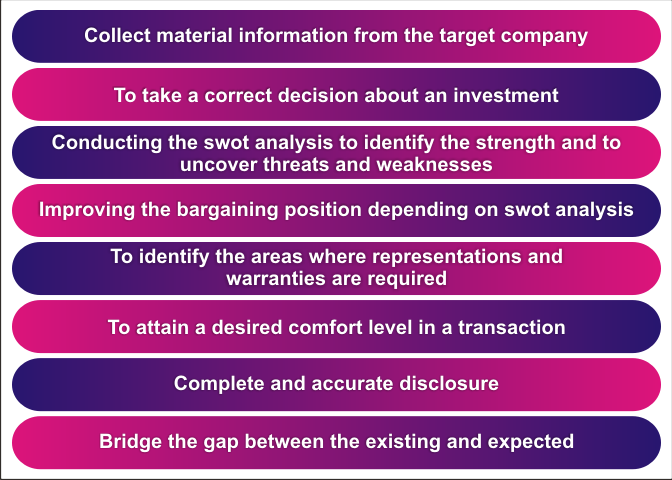

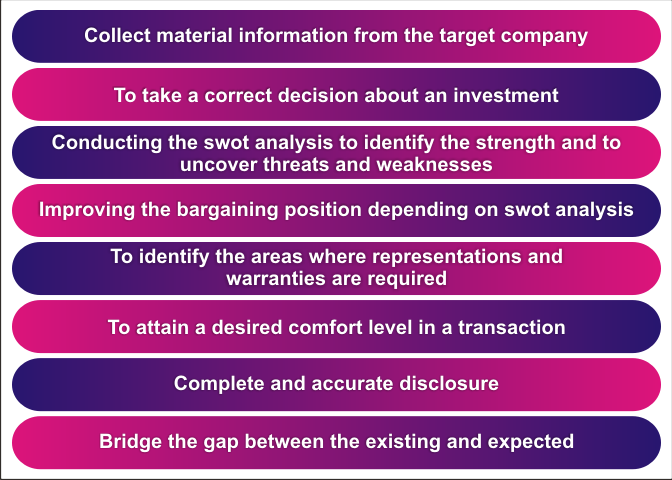

benefits

Due diligence is required so that the unit is well aware of all necessary things:

- Administration and Ownership

Company run analysis.

- Capitalization

Testing how big and volatile the company and market are. The opposite of both requires analysis.

- Business Competitors and Industry

Researching and comparing competitors' boundaries for better understanding of target company

- Balance Sheet Review

This helps explain the debt-to-equity ratio.

- Revenue, Profit and Margin Bearings

To check if there is any recent trend in the data that may be rising, falling or may be stable.

- Risk

Know industry-wide and company-specific threats. Investigating whether there is a risk and trying to predict an unexpected threat in the future.

- Capital History / Options and Prospects

How long has the company been in operation? For a short period or a longer period? Is there a fixed stock price?

- Expectations

To get maximum profit for future.

Checklist

The checklist includes financial due diligence, legal due diligence, operations, human resources, etc., which are reviewed and evaluated by the due diligence advisor.

- Certification of incorporation

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Financial Summary

- IT Returns

- Bank Report

- Tax Certification Certificate

- sharing creation

- Statutory Declarations

- Property Record

- Intellectual Property Certification / Application

- service bill

- Environmental Audit / License and Permit

- Biographical data

- Labor dispute, if any

- Employment and loan contract

- Employee takes advantage of documents

- Employment Manual and Policies

- Operational documents related to the list of company’s suppliers, monthly production capacities and yield, the backlog of production, inventory reports, etc.

Servzone Practices

Questionnaire

- On instruction, we will present to the investment recipient a due diligence questionnaire, which aims to extract all relevant material data about the targeted investment.

- The questionnaire is uniquely based on the specific form, but will be tailored to the particular occupation and sector. Advocates of the investment recipient will continuously coordinate the acceptance of the questionnaire, with expert lawyers / advisors distributing their field answers. It is also common that in many cases, directors and senior administrators can compile and present this information.

Trusted data cell

- All data will be made accessible through a secure data room, with preview rights for investment beneficiaries and their advisors by us.

- Our standard approach is to use a 'virtual data' cell addressing the privacy issue. Nevertheless, we reserve the right to demand as required. Entry to the data room is often for a limited period and a small number of personalities can be focused at any one time. The 'data room' will contain all the information compared to the investment objective.

Interview with beneficiary management

Even though the administration is always best placed to present this information on the target's enterprise and prospects, we will handle management interviews in a similar way, as we make it an essential part of our 'due diligence' process Let's make. I

see

Internal and external public registers

Public records, however, may not be fully up-to-date, and will be part of our due diligence structure, where diligence inquiries take place everywhere. Outside search is not limited:

- Examination where the target, the guarantor of the investment recipient is a company.

- Organization registrar, bankruptcy and court records;

- Where the guarantor or target partner is an individual, a research of the 'Personal Insolvency Register' for current and fresh bankruptcies, current personal voluntary agreements, debt relief orders and current bankruptcy limitation orders and projects

- Trademarks, trademarks, patents and records of recorded / certified designs prepared by intellectual property offices;

- search for land registers;

- Commercial learning providers such as Dun & Bradstreet;

- Comprehensive search of Target through target websites, and internet hunts and any other actual searches and information requests.

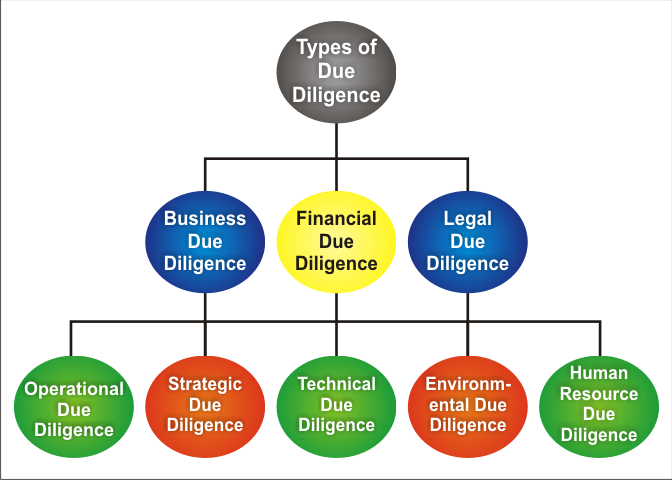

Types of Due Diligence

Due Diligence – Focused Area

The important factors to keep in mind while considering the reasons given below -

- Explain the party's expectation in terms of revenue, profit and profitability of the target company.

- To check whether the parties concerned have the resources to make the business successful. Furthermore, the party is ready to do all the hard work required for the new venture.

- Consider whether the business gives the concerned party an opportunity to make good use of skills and experience.

- The parties concerned should also pay attention to competitors and industries, valuation multiples, management and ownership and risk factors.

Servzone Deal Regime

- Strategy

- Target Credentials

- Non- Disclosure Agreement

- Assessment

- Letter of Intent

- Due Diligence

- Deal Construction

- conversation

- Contracts & Share Purchase Agreement

- Deal Completion/Close

step to stap process

- Analyze Capitalization

The market capitalization, or total value, of a business registers how active the stock price is, how broad its title is, and the likely size of the company's destination markets.

- Resource Acquisition, and Margin

The company's earnings report will list its revenue or its net income or profit. It is necessary to monitor the trends of a business's revenue, operating expenses, profit margins, and return time on investment.

- Rival Comparative Studies

Each business is determined in part by its competitor. Check the profit margins of your two or three competitors. Performing due diligence on multiple businesses in the same industry can give the investor an idea of ​​how the company is performing and what activities are leading the way.

- Evaluation multiplication

Different ratios and economic matrices are used to estimate companies. Nevertheless, three of the most valuable are the 'Price-to-Earnings' (P / E) ratio, 'Price / Earnings to Growth' (PEG) ratio and 'Price-to-Sales' (P / S). Ratio.

- Administration and Shared Ownership

Is the company still run by its promoters, or has the board been rearranged to several new features? Fresher companies serve founder-led. Research officers' bios to find out their level of expertise and knowledge. Bio-knowledge can be found on the company's website.

- Balance Sheet

The consolidated balance sheet of the organization will show its assets and liabilities, as well as how sufficient cash is possible. Find out the debt-to-equity ratio to see how much tangible equity the company has.

- Stock cost history

Investors should examine both 'short-term' and 'long-term price' movements of the stock and whether capital has remained animated or stable. Connect historically created profits and determine how it interacts with the price movement.

- Stock Suspension

There should be research on how many shares of the company are exceptional and this number is related to competition. Is the company representing the issuance of more shares? If so, the share price may be a hit.

- Investigate long and short term risks

Be sure to understand both industry-wide risks and company-specific risks. Are there outstanding legal or regulatory matters? What is unstable management?

Differences between Due Diligence and Statutory Audit & Internal Audit

In India, companies statutorily required to get their accounts audited by an unconventional Chartered Accountant. In some cases, companies needed to carry out an internal audit relating to their method. Due diligence is quite distinct from internal and statutory audits.

Tax Outline

Tax due diligence represents a prominent role in M&A determination, though the tax usually is not the primary concern in the context of M&A deal. Customized, tax liability is used to explain more about the target's tax profile and to reveal any tax exposure and quantify it. Nevertheless, tax due diligence also involves identifying any tax ups that may reach the target. It also helps to distinguish and develop a suitable procurement structure for the deal in question. The buyer has to consider this when negotiating for tax protection to ensure that it does not affect the professionalism of the business for the seller. A tax due diligence is traditionally carried out:

- Verify details made by the seller at the time of pre-transaction discussion related to tax matters.

- Verify the tax assumptions presented by the buyer in evaluating the target.

- It is stripping out any material tax publications that may be remaining with the target, including the symptoms of such tax exposure.

- Identify any physical upsurge possible tax benefits such as being retained until the end.

- Structure the enterprise in a tax-efficient practice.

- Evaluate the availability of tax losses, tax credits and other tax assets.

- Guarantee adequate safety net for the buyer.

Why Servzone?

Because we consist of

- Stamina, energy and confidence to resolve issues and work on time and deadlines

- Professional recognition combined with practical experience and a curious mind

- Identify key drivers to ensure a focused approach, be alert to problem areas and disparities

- Presentation personal skills and ability to express clearly, and without ambiguity

- To provide relevant expertise and targeted and useful due diligence feedback that adds value

GST Registration

PVT. LTD. Company

Loan

Insurance